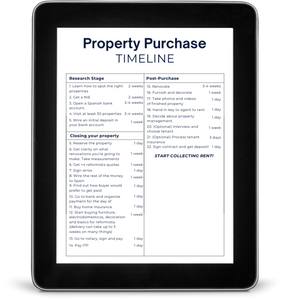

Free Property Purchase Timeline

Understand exactly what to do and when before, during and after buying property in Spain.

You're all set!

Every action step you need to take (and when) for a stress free investing process in Spain.

If you are trying to spot a great deal in the Valencia real estate market by scrolling listings and waiting for something to feel right, you are getting left behind my friend.

Most buyers never spot real opportunities because they rely only on portals like Idealista, wait for perfection, do not see enough inventory, avoid uncomfortable properties, and let emotions override numbers. That combination almost guarantees overpaying.

Here is the key shift you need to make as an investor. A good deal is not identified emotionally, it is identified numerically. You do not buy because you like a property. You buy because, after running conservative numbers, the margin is there even if the property needs work.

In this article, we’ll break down how experienced investors actually spot good deals in the Valencia real estate market, where those deals are really found, why they rarely appear online, and how running the numbers removes doubt from decision-making.

Why You Almost Never Find Real Deals on Idealista

Idealista serves two purposes in the Valencia real estate market.

First, it is used to promote normally priced properties that leave room for negotiation.

Second, it acts as a gateway to something more valuable, direct access to local agents. Smart investors use Idealista to start conversations. You view properties, build rapport, and ask what else is coming up in the agent’s portfolio. Then you follow up consistently, stay visible, and remain patient.

Where Real Deals in Valencia Are Actually Found

The best opportunities in the Valencia real estate market come through direct relationships with local agencies.

Agencies do not post their best properties immediately. They protect good opportunities for buyers they trust. They prioritize people who can move quickly, make clean offers, and close fast. If it still hasn’t sold within their group of investors, they’ll post on their agency’s platform over Idealista or Fotocasa.

Seeing A Lot of Properties Is A Must

You cannot spot a deal if you do not know the baseline.

Most buyers see five or six properties and think they understand the market. They do not. Early viewings serve as education. The purpose of seeing many similar properties is to build pattern recognition.

By seeing volume, you learn:

- Price per square meter ranges in different areas

- Common layout problems and strengths

- Typical renovation costs

- What “average” actually looks like

- What you are really looking for.

At a certain point, something shifts. You walk into a property and immediately know it is underpriced. Not because it feels exciting, but because it breaks the pattern you now recognize. That moment only comes from repetition.

Investors do not feel deals. They recognize them.

Red Flags of a Potential Deal

Not every red flag means “walk away.” In the Valencia real estate market, some of the best opportunities show up precisely because something feels inconvenient, messy, or unresolved. The key question is always the same, is this a real risk, or just friction that scares off other buyers?

Here are red flags that often signal a potential deal, if the numbers support it.

Incomplete or Missing Paperwork

When a property does not clearly have the correct use (residential vs commercial), does not have its own services (individual water and electricity meters), or appears to have been divided without proper registration, most buyers get scared off.

Although these situations often signal disorganization, inheritance cases, absentee owners, or sellers who are not fully prepared to sell, these are probably the reasons you are getting the price your getting and maybe even giving your more negotiating power.

But remember that this is only a deal if the situation can be regularized. When it can, price flexibility often follows, because the seller knows not all buyers are willing or able to navigate the process.

Property Cannot Be Visited (Okupas or Access Issues)

Properties that cannot be viewed due to okupas or access restrictions are immediate deal-killers for most. But for others, these make sense if you fully understand the legal process, timelines, and costs involved. When priced correctly, these properties can offer significant upside, but they require experience, patience, and conservative assumptions.

On the Market for a Long Time

A property that has been sitting on the market longer than similar listings often hides opportunity. Perhaps it was overpriced and the seller’s expectations are slowly adjusting. Time creates fatigue, and seller fatigue creates leverage. Long market exposure is not a problem, it is a signal to investigate further.

Property Characteristics That Often Indicate Upside

Great deals in Valencia often share similar characteristics.

They are old but structurally sound. They have old kitchens and bathrooms. They may have awkward layouts that can be improved easily. They often have strong fundamentals like good light, high ceilings, and solid buildings that are overlooked because the finishes are dated.

Most buyers are visual. They want turnkey. Investors want fixable problems. When others hesitate because something does not look perfect, margin often exists.

Seller Motivation Matters

Motivation creates opportunity more reliably than negotiation tactics.

Inherited properties, owners living abroad, divorces, family restructurings, or long-term rentals that have just become vacant all tend to create flexibility. Time pressure often shows up subtly during conversations, not in listing descriptions.

Location-Based Discounts That Create Opportunity

Not all discounts come from bad neighborhoods. Many come from imperfections inside good areas.

Fourth floors without elevators, awkward layouts, busy streets, or commercial ground floors all reduce demand. But investors who price inconvenience correctly are rewarded for it.

Issues of this kind often offer better long-term performance than marginal neighborhoods with perfect properties. Understanding this distinction is critical when investing in the Valencia real estate market.

Math That Confirms a Real Deal

Numbers are where deals are confirmed or killed.

Investors break properties down into simple components: purchase price, renovation cost, total investment, realistic rental income. Optimism has no place here. Conservative assumptions protect capital.

Renovation only creates value when the math works comfortably. If a deal only works in a perfect scenario, it is not a deal.

At some point, your questions change.

You stop asking if the property is nice. You start asking how fast you can move and what your downside looks like. The numbers work even under conservative assumptions, and you do not need reassurance from agents or friends.

Confidence comes from math, not emotion.

This is where we come in.

We help investors like you buy property in Spain strategically, not emotionally. Instead of selling listings, we guide you through the process and risk so you can identify real opportunities and avoid costly mistakes. Our role is simple, help you buy the right property, at the right price, with a strategy that actually works.

We do not sell properties. We help investors buy well.

Free Property Visit Checklist

Evaluate Spanish properties during visits, so you can spot red flags and avoid costly mistakes.